Table of Contents

How Political Economy Impacts Monetary Policies and Economic Stability

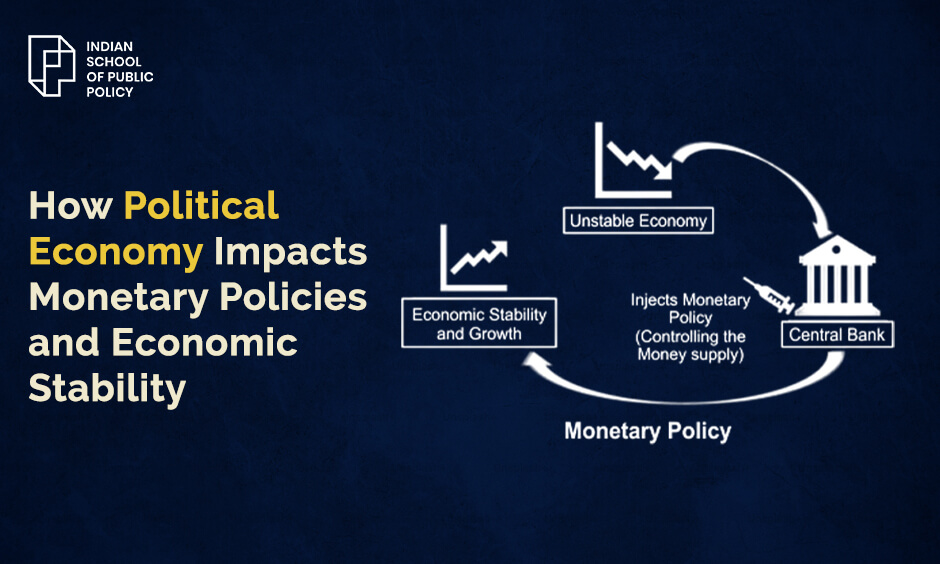

Economic stability is not achieved in a vacuum. It is formed by an intricate interplay of political choices, fiscal demands, public expectations, and institutional systems. The lens of political economy enables us to understand how these elements effect the making and triumph of monetary policy—which includes not just interest rates, but also currency management, debt financing, inflation targeting, and public trust.

Whether it’s electoral forces pushing governments to delay dire reforms or global investors reacting to political risks, monetary policy is never just a simple exercise—it’s usually political. Central banks or finance ministries do not operate individually; their choices and decisions are many times swayed by the prevailing political environment, the focus of the ruling party, and the short-term trade-offs demanded by voters or markets.

In nations where institutes are strong and power is transparent, monetary policy can be a robust steadying influence. But wherever institutional autonomy is ineffective, economic outcomes often display short-term mainstream programs rather than long-term national health. Recognizing this expansive context is critical—not only for policymakers, but also for society and stakeholders who rely on monetary policy to preserve progress, control inflation, and ensure financial strength.

Understanding Political Economy and Monetary Policy

Monetary policy, whether it is about interest rates or currency supply, is driven by long-term economic goals. However, political economy brings to the spotlight how practical governance—from fiscal demands to election cycles—forms monetary outcomes.

For example, Reserve Bank of India (RBI) and other central banks like the American Federal Reserve are intended to be independent, but they frequently function under pressure from government leaders, particularly during economic slumps or in time periods before election. This leads to a persistent mediation between economic judgment and political convenience.

In addition to the autonomy of central banks, monetary policy is also influenced by:

- Fiscal policies and public spending priorities

- Electoral cycles and populist agendas

- Coalition politics and legislative bottlenecks

- Global financial dynamics and trade politics

- Institutional trust and state capacity

Each of these factors affects how capital flows, how inflation is controlled, and how debt is perceived—eventually shaping economic strength.

Critical Channels that Influence Policy

1. Autonomy of the Central Bank

An independent central bank is more prone to resisting pressures from political agents and preserve long-term stability. Research illustrates that nations with superior central bank sovereignty commonly have lesser inflation rates. Conversely, when governments try to way decisions or key appointments, it can wear away trust and credibility.

Case-in-point: A reported rift in 2018 between the RBI and the Government of India over interest rates and reserves, emphasized the strain between partisan demands and institutional independence.

2. Monetary-Fiscal Coordination

Administrations depend on fiscal policy (taxation and spending) while central banks focus on monetary policy. In an ideal world, these two ought to complement each other. But when governments follow expansionary fiscal policies—particularly ahead of elections—they could end up putting pressure on central banks to maintain low interest rates, which in turn could lead to inflation or asset bubbles.

For example: The post-pandemic stimulus in several countries like Canada and Japan required coordinated efforts between central banks and their respective ministries of finance, but also raised queries about debt sustainability and inflation control. (Read more – CEPR report)

3. Elections and Populism

Government chiefs frequently confront temptations to advance the economy before elections, at times by encouraging relaxed monetary circumstances. These interim moves may benefit their respective parties electorally but can have far-reaching economic costs.

Turkey is a warning story: Repeated interventions by President Erdogan in policy of the central bank, including firing bankers for not reducing interest rates, led to currency depreciation and extreme inflation. (Read more – BBC report)

4. Market Reactions to Policy Credibility

Markets respond not only to policy choices but to perceptions of institutional strength and stability. If stakeholders perceive that monetary policy is being dictated by politics rather than economics, they may raise risk premiums, pull out capital, or weaken the currency.

Argentina has long toiled with such credibility issues, where erratic political influence has damaged monetary policy effectiveness and investor confidence. (Read more)

Global Models in Action

-

- United States: The U.S. Federal Reserve demonstrates how central banks in democratic systems operate under continual scrutiny. During President Donald Trump’s administration, then-Chair Jerome Powell encountered open criticism for interest rate hikes, with Trump publicly calling for rate cuts to stimulate the economy. Yet, the Fed held its course, emphasizing its institutional resilience.

- In contrast, under President Joe Biden, the Fed acted in a focal role in managing unemployment and inflation in the post-pandemic recovery period—harmonising aggressive rate hikes with unease about economic slowdown. These changeovers show how political leadership styles and macroeconomic narratives can shape monetary expectations and institutional responses.

- Eurozone: The European Central Bank (ECB) operates in one of the most complicated political markets worldwide. Tasked with establishing integrated monetary policy across 20 member states with differing fiscal attitudes and political concerns, the ECB frequently navigates contra-national demands.

- For example, while northern countries like Germany emphasize inflation control, southern economies such as Italy and Spain are more concerned with debt sustainability and growth. The ECB’s response to the Eurozone debt crisis, quantitative easing programs, and its recent stance on inflation demonstrate the delicate act of maintaining unity, integrity, and economic stability across a highly diverse union.

Best Practices and Key Lessons Going Forward

- Reinforce Central Bank Independence: Institutional design and its inherent laws should insulate central banks from unnecessary influence. The U.S. Federal Reserve and the ECB serve as global models. Clear legal mandates and protected tenure for central bankers can safeguard monetary policy from short-term political cycles.

- Clear Communication: Central banks like the Bank of England broadcast in depth minutes and forecasts, building market and public confidence. Friendly dialogue decreases ambiguity and anchors inflation expectations, enabling smoother transmissions of policy.

- Institutional Credibility: Stability is about people and perception. Countries with trusted institutions are better able to manage volatility. Credibility acts as a form of policy capital, allowing governments and central banks more flexibility in crisis response.

- Long-Term Orientation: Encouraging buffers, sticking to inflation targets, and opposing populist fiscal pressures are vital. A forward-looking approach builds investor and citizen confidence and ensures resilience against global shocks over time.

ISPP and Its Role in Policy Leadership

Developing economies like ours face a distinctive challenge. They must ensure progress, maintain external stability, and manage inflation—all while navigating vibrant democracies with active political discourse. Improving data-driven governance, strengthening institutions, and safeguarding transparency in monetary-fiscal coordination are essential.

Moreover, international concerns like geopolitical tensions, climate change, and financial issues require robust and politically agile economic institutions.

The Indian School of Public Policy (ISPP) plays a key role in training the next generation of policy thinkers who can recognise the myriad tones of political economy. Across a curriculum based in public finance, behavioural insights, economics, and institutional design, ISPP arms researchers with means to traverse the delicate balance between politics and economics.

Alumni of ISPP are trained not only in technical policy design but also in political communication, stakeholder negotiation, and ethical leadership—qualities necessary to build monetary policies that are both reliable and comprehensive.