Table of Contents

Revdi Culture for Vote bank: A Fact-check on Economy

On 16th July 2022, Prime Minister Narendra Modi, while addressing the crowd during the inauguration of the newly built Bundelkhand Expressway in Uttar Pradesh, said that “Revdi Culture” (freebies) for votes should be done away with. He emphasized that freebies do no good for the development of the country.

Debate on Revdi Culture

‘Revdi’ is a popular North Indian sweet dish made from sesame and jaggery. This sweet became the centre of controversy when the PM, during his speech at the expressway inauguration said, “This Revdi culture is very dangerous for the development of the country. Those practising Revdi culture will never build new expressways, new airports, or defence corridors for you. Together we have to defeat this thinking and remove Revdi culture from the politics of the country”.

Why ‘Revdi’?

Recently, Sri Lanka fell into its worst-ever economic crisis which led to massive protests. This led to the resignation of Prime Minister Mahinda Rajapaksa. There were reports of President Gotabaya Rajapaksa fleeing the country and heading to Singapore after his government failed to secure a bailout package from the IMF. This Economic crisis is not the result of a year or two, but more than two decades. A major reason cited by the experts for this crisis in Sri Lanka is the promise of freebies during elections.

In recent times, India has seen many political parties offering freebies to people to secure a large chunk of votes and win elections. Let us see some examples:

- Tamil Nadu– In 2013, the Tamil Nadu government started a food subsidization program (Amma Unavagam) run by the Ministry of Food and Civil Supplies. The program was meant for the poor initially but later, it was opened to all.

- Similarly, the Karnataka government introduced “Indira Canteens” in Bengaluru on 15th August 2017, less than a year before the state assembly elections in April 2018.

- Before the Delhi Assembly Elections in 2013 and 2015, a political party in Delhi announced that it would offer 200 units of free electricity and 20 kiloliters of free water to every household, irrespective of house type or income.The same political party made similar electoral promises during the Assembly elections in Punjab and Goa in 2021. The same trend continued in 2022 during the Gujarat election season.

- In the 2019 General Elections, a major national political party promised to offer a whopping Rs 72,000 to farmers annually as a part of their Minimum Income Plan. When questioned by the media, a former Union Finance Minister representing that party replied that the program will cost approximately Rs. 3.7 lakh crore annually and was unable to clearly explain how the project would be funded.

These examples illustrate how revdi is a common practice followed by prominent political parties in the country. This phenomenon raises two obvious questions: What would be the source of funding for these projects? Would the burden of high revenue generation be put on the taxpayers through higher or new taxes?

Recent Trends

In recent developments, we have seen that many state governments are borrowing from the Government of India or from the World Bank in the name of state borrowing to fund ‘highly subsidized programs. The RBI recently pointed out in their June bulletin titled “State Finance: A Risk Analysis” that some state economies are in peril because of such highly subsidized programs. As per the RBI document, “A major motivation for undertaking this analysis is the unfolding of the crisis in Sri Lanka, which has culminated in its first-ever debt default on May 19, 2022.”

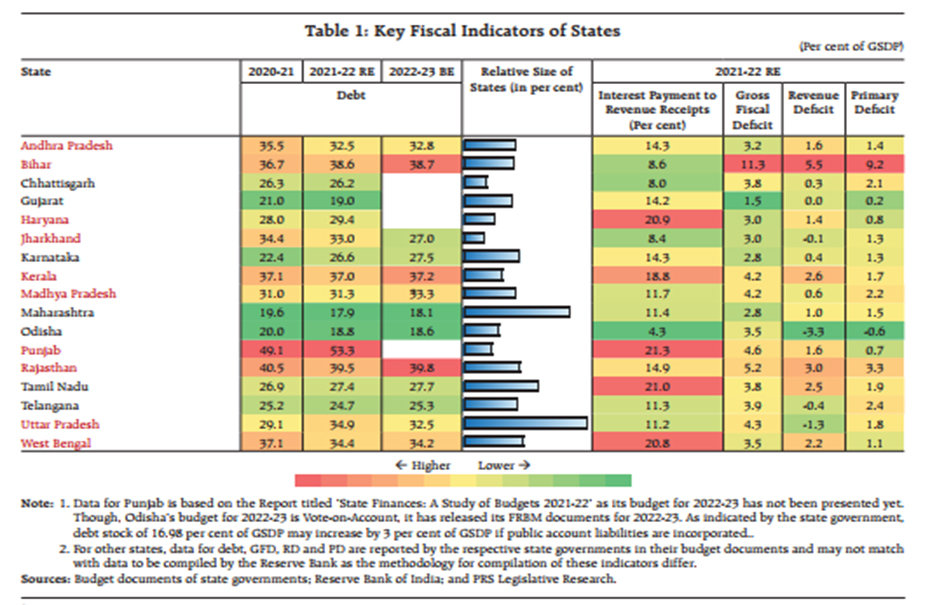

Table 1:

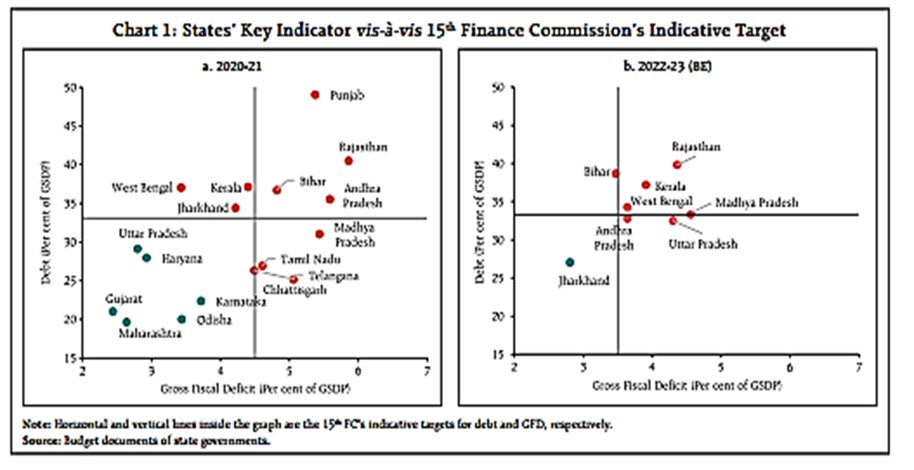

Chart 1

Both the table and the chart have been sourced from the RBI document on State Finances. The Table shows the key financial indicators of the states which include Debt as per BE and RE of the State Budgets. It also depicts the GFD-GSDP ratio along with the Revenue Deficit and the Primary Deficit. It also shows the Interest Payment to Revenue Receipts.

Chart 1a depicts GFD vs Debt, both in terms of the percentage of GSDP for FY 2020-21. These were the targets set for the States by the 15th Finance Commission.

Chart 1b depicts the same for FY 22-23 as per the BE of the State Budgets. From here we can infer that some states will miss their respective targets in the upcoming fiscal year.

Way Ahead

India is a land of paradoxes and complex problems. Many do not have enough money to feed their own families. On the other hand, there is a category of people who spend thousands in lavish hotels and restaurants for one meal. India needs subsidized programs for the targeted beneficiaries and not the ones who fall in the category of ‘haves’. This requires improving beneficiary targeting and increasing revenue sources beyond taxing people. Some economists and policy experts have called for the Government of India to urgently come up with solutions to mitigate this issue. Some urge to reduce subsidies on food grains, while some advise the Government for massive industrialization to mitigate this problem. The union and state governments must act swiftly so that we can avoid a Sri Lanka-type situation.