The Problem of Underdeveloped Investment Markets in Developing Countries

Abstract

The problem of underdeveloped investment markets has been a significant cause of concern in developing countries. In a country like India, where infrastructural projects often have long gestation periods and are subjected to high risks, they do not receive adequate investment. Asymmetric information and adverse selection emerging due to ambiguity in risk assessment lead to poor participation by diverse investors. It affects the low-risk project developers more, as they are willing to offer lower average returns. This pushes them out of the market due to the high cost of capital, following which the low-risk investors also withdraw due to the seemingly high-risk profile of projects, thus weakening the market. This paper explores how a project developer can gain more credibility and stay in the market (accessing investment at reasonable rates) by applying various game theory tools such as signals and other instruments.

Background

The underdeveloped investment markets in developing economies such as India have long been a cause of concern for development enthusiasts. This holds true, especially in the context of sectors such as infrastructure, which involve projects that have a long gestation period and are simultaneously subject to greater risks. On closer analysis, we can see that the underlying problem behind the underdeveloped investment markets is that they are characterised by the problem of asymmetric information. Asymmetric information in this case implies that the project implementers are aware of the risk profile of the project, whereas often the investors are not.

This in turn leads to the problem of adverse selection, which causes a death spiral and market failure as explained below:

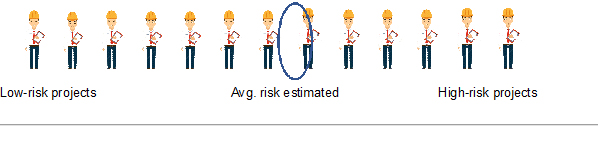

Before investing in a project, The investor, because of his limited knowledge, draws up a risk estimate based on the average risk profile of similar projects in the country. He decides on the minimum desirable return that he will seek, commensurate to this average risk.

Now, the high and average-risk project developers will be willing to provide the returns sought by investors. However, for low-risk projects, the return sought is too high and consequently, the cost of capital is unjustified. Therefore, low-risk project developers will probably withdraw from the credit market.

Since the risk profile undergoes change, the average risk estimates and commensurate returns sought by investors increase. This in turn will lead to the further withdrawal of relatively lower-risk projects among those remaining in the market.

This iterative cycle is called the death spiral and leads to a market failure/collapse.

The low-risk projects and low-risk low-return-seeking investors are dissuaded from joining the market, resulting in a largely underdeveloped investment market that offers capital at a very high premium. This impacts development projects in the country and is detrimental to their growth.

Solutions:

To address the above challenge, multiple solutions can be employed:

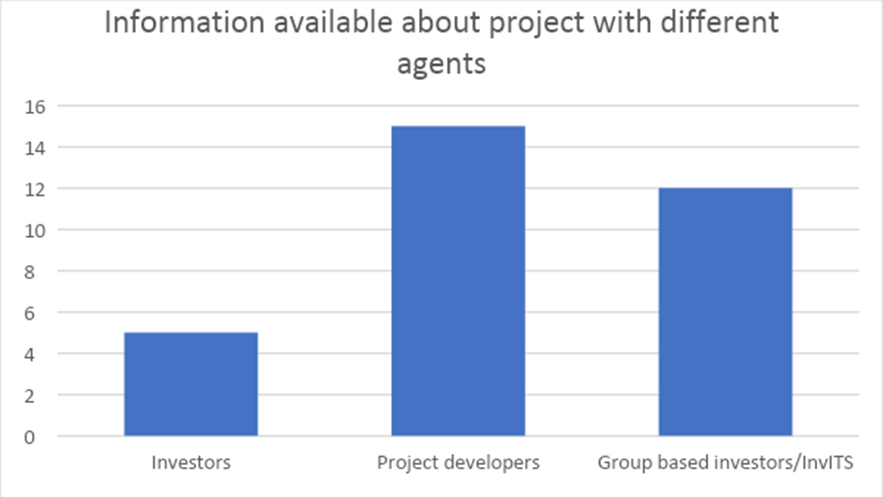

- Group-based lending/investing: Under games of incomplete information (asymmetric information), investment agencies or investors can benefit from group lending/investing provisions. They can invest in groups/investment pools that self-screen their constituent members/projects based on (high-risk, low-risk, etc.):

- Endogenous group formation and self-selection of members of the group (Van Tassel, 1999) – Players with similar risk profiles come together to seek investment and share liability for giving returns. They have more information about projects and can select other members of their grouping better compared to investors.

- In the infrastructure space, INVITs are one such type of investment pool that help reduce the information asymmetry between investors and project developers.

- An Infrastructure Investment Trust (InvITs) is a “Collective Investment Scheme similar to a mutual fund, which enables direct investment of money from individual and institutional investors in infrastructure projects to earn a small portion of the income as a return.”(NSE definition).

- InvITs help reduce project-associated and investment risks by choosing a healthy balance of projects (underdevelopment and operational). They also have a better talent pool of fund managers that reduce Information gaps by using research and tools like hedging (R, 2021). This leads to a reduction in information asymmetry and attracts a greater number of low-risk investors in the sector as well, thus strengthening the market.

- Ensuring more transparency: Information regarding project-related risks (land acquisition and other risks in the case of the infrastructure sector) and operational risks must be made available.

- Credit risk ratings for projects and sectors preferably by third party rating agencies (which are independently financed) could also be introduced. E.g.: Credit risk rating agencies like CRISIL, India Ratings.

- Game theoretic approach of signalling can be employed to assuage fears of the investors.

The Game theoretic approach of “Signalling” to tackle Information Asymmetry.

We shall be analysing the Game-theoretic approach of signalling that project-implementing agencies (especially those of safe or low-risk projects with mitigated risks) can employ to appeal to investors and thus reduce information asymmetry between them and project implementers.

This includes-

- Assuring investors in the form of central banks or state government assurance/sovereign guarantees.

- Guarantees from other multilateral and development banks.

The above signals are costly to send for the high-risk project developers vis-à-vis low-risk project developers. This signifies to the investors the confidence of the project developers and the government backing them. As a result, investors’ belief in the success and feasibility of the projects rises and s/he is more likely to invest in the project at cheaper rates.

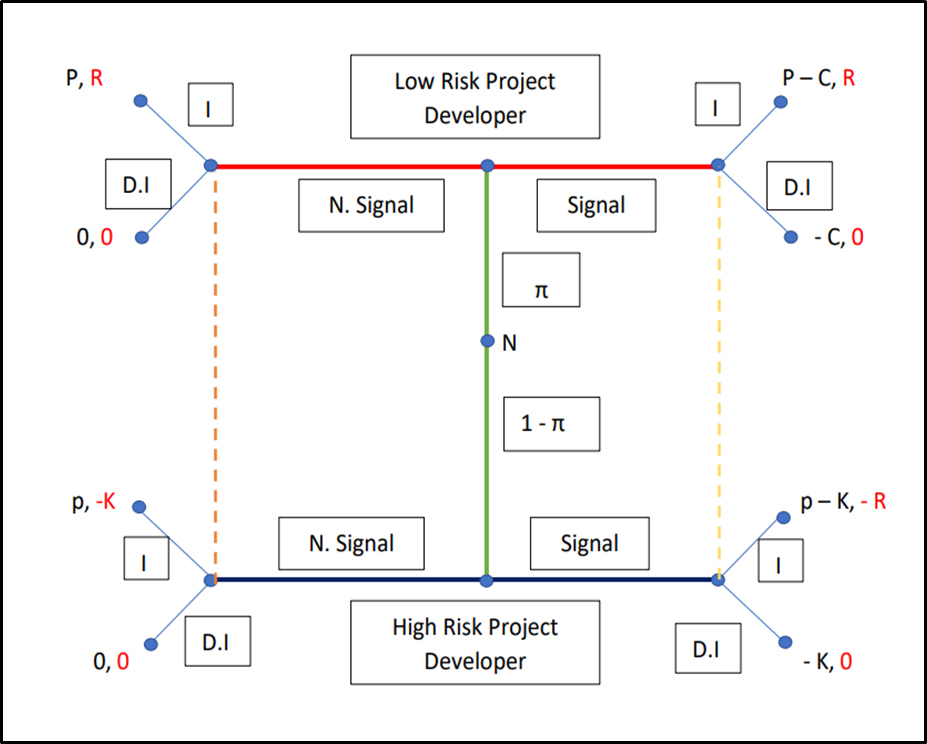

The game tree:

Let us assume that there are 2 players: one with a low-risk project and one with a high-risk project. The project implementer has an idea about the risk of the project but not the investor (who is at a disadvantage).This is a game of incomplete information.

For the signalling to be effective, it should be a separating equilibrium i.e. the signal should be seen as distinctive by the investors and the investors should be sure that if a signal is being given (guarantee in this case), it must have been given by the low-risk investors and not the high-risk investors.

The signal should be profitable for low-risk investors to give and not the high-risk investors.

The payoffs are assumed to be as follows:

- The investor gets a payoff of R if it invests in a low-risk project and -R if it invests in a high-risk project. He gets a payoff of 0 if he does not invest.

- The low-risk project developer gets a payoff of 0 if the investor does not invest. He earns a profit of P and has to pay a cost of C if he signals.

- The high-risk project developer gets a payoff of 0 if the investor does not invest. He earns a profit of p and the cost of the signal is K.

- We assume that the return p>P.

The tree for the above game shall be:

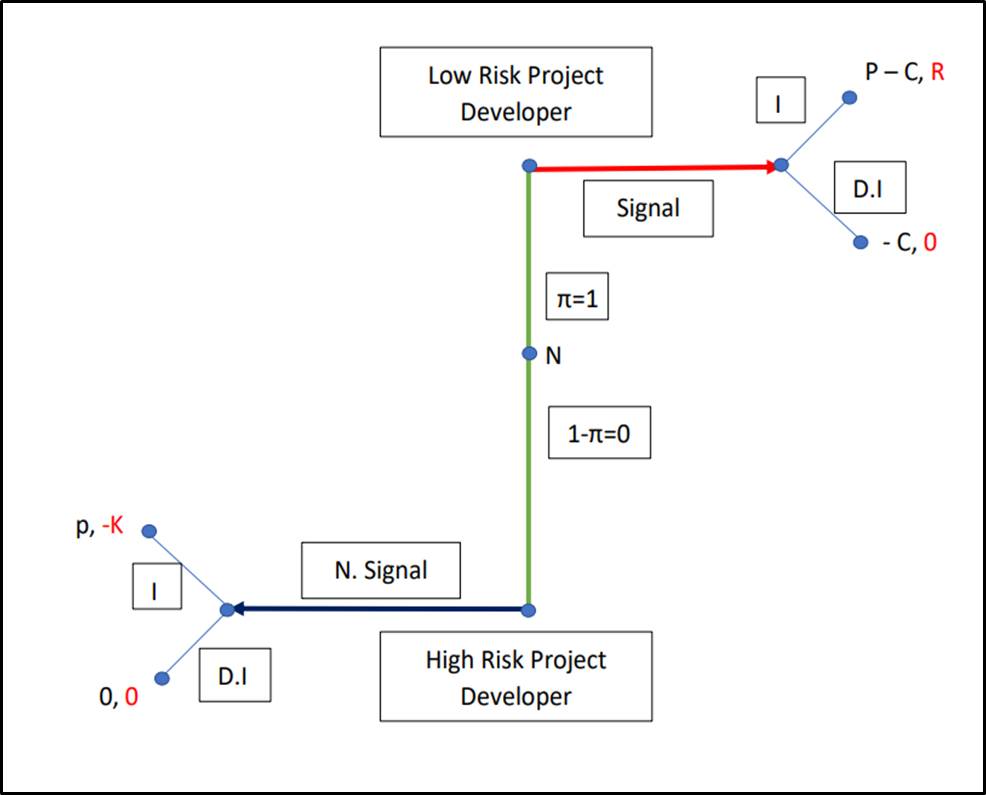

Thus, the desired separating equilibria for the game should be

- Low-risk project developer(LRPD)-> Signals (Guarantees)

- High-risk investor developer(HRPD)-> Does not signal (Does not guarantee)

- Investor invests when he gets a signal, the investor does not invest when he does not get a signal

Now, let us analyse what should be the payoffs and cost of signal for the above separating equilibria for it to be a Perfect Bayesian Nash Equilibria (PBE).

The Game tree for separating equilibria shall be:

For PBE (Perfect Bayesian Equilibrium):

- We keep the project developers’ strategies constant and search for the investor’s best response.

- When LRPD signals and HRPD does not signal, then

- The investor’s best response will be to invest when s/he gets a signal (payoff of R greater than 0), and not invest when s/he does not get a signal (payoff of -R less than 0).

- Keeping the investor’s strategy constant, we shall analyse the project developer’s best response.

- Investors invest when signalled and do not invest when not signalled.

- LRPD’s best response, in this case, will be to send a signal if (P-C>0), and HRPD’s best response will be to not send a signal if (p-K<0).

We can conclude that we will obtain a PBNE if C

Therefore, for effective and distinct signalling, the cost of the signal should be more than p for HRPD and less than P for LRPD

Register your Interest to Study at ISPP

Conclusion

Signalling can be an effective solution to resolve the problem of asymmetric information and market failure. The solutions prescribed above are used in some forms across different sectors.

In the context of the infrastructure sector, the Government of India (GOI) along with other developing countries, has employed or is in the process of employing the different solutions prescribed below such as:

- InvITs

- Third party credit rating agencies

- Public disclosure of information about projects (through setting up data rooms for projects, and online portals displaying project clearance and progress status). (For instance, it was used in REWA solar project, defence and industrial corridor projects in UP, and many other infrastructure projects)

- Signalling tools such as guarantees (Sovereign or Multilateral investment bank funded) or assurances in the form of VGF (viability gap funding).

Therefore, it is evident that several challenges in the economics and public policy space across sectors due to the interaction between strategic agents having different and often conflicting incentive structures can be resolved through the application of Game-theoretic and other such tools.

References:

- Van Tassel, E. (1999). Group lending under asymmetric information. Journal of Development Economics, 60(1), 3–25. https://doi.org/10.1016/S0304-3878(99)00034-6

- R, C. (2021, November 10). Anatomy of Risks in PPP Projects in India and How to Mitigate Them. Fox Mandal. https://www.foxmandal.in/anatomy-of-risks-in-ppp-projects-in-india-and-how-to-mitigate-them

Bibliography:

- India’s risky investment climate | Financial Times (ft.com)

- Asymmetric Information, Signaling, and Game Theory – Atlas of Public Management (atlas101.ca)

- Signaling | Microeconomics Videos (mru.org)

- Anatomy of Risks in PPP Projects in India and How to Mitigate Them – Fox Mandal

- 15. Solving Separating Equilibrium of Signalling Games (Game Theory Playlist 10) – Bing video